An eight Bullet Point summary of why the "Jones formula" to make NZ sawmilling great again is doomed to failure

Wednesday, June 03, 2020, Dennis Neilson's blog

Some reasons why Minister Jones’ attempt to re-direct some or all of the ~20 million cubic metres per year of export logs to domestic sawmills to process more sawn timber and create more jobs -- is doomed to failure

- Only three sawmills of 60 in NZ (Red Stag Rotorua, CHH Kawerau and CHH Nelson), working even part-weeks, can over-supply the entire NZ market for sawn timber. This over-supply will get worse (a lot worse), as annual NZ housing starts reduce from 37,000 in 2019 to between 11,000 and 20/25,000 in the next 12 months (BNZ prediction). One other very experienced observer said today, “NZ sawn timber demand will likely halve over the next 3 years compared to 2019.” And last night it was predicted that Australian housing starts will fall from 160,000 to 110,000 per year

Other (smaller) mills producing for the NZ market only make the oversupply worse. And, once a huge expansion to one of these three sawmills mills (CHH Kawerau) is complete the oversupply situation will get even worse.

- NZ sawmills cannot export structural housing timber to Australia, as almost no NZ pine timber can meet Australian building timber stiffness standards ( MGP10 & MGP - e.g. MGP10 indicates a minimum threshold for stiffness properties of 10,000 MPa). So 70% of total Australian wood demand is out of bounds to NZ exports. As a result of changes to the Standards and European competition, NZ sawn timber exports to Australia have fallen by 75% from 2000 to 2018.

- In the last 10 years while governments in Russia, Europe and latin America have subsided the building of dozens of huge new sawmills and other mills costing $10s of billions, the undercapitalised and non-subsidised NZ sawmilling sector has languished. While being in the top quartile of global scale and efficiency in the 1980s, it has “fallen off the cliff” to be in the bottom quartile globally (with two of 60 mill as exceptions). European sawn timber shipments to Australia have increased by more than 500% from 2000 to 2018 - the biggest single “nut-crusher” of the NZ timber export industry. All this Pinus sylvestris (Scots pine) and Picea abies (Norway spruce) timber meets Australian Standards.

- NZ sawmills have not been able to find a single cubic metre of extra export sawn timber market volume in the last 18 years - in fact it has found less from 2002 (1.835 million m3) to 2019 (1.821 million m3).

And it is only going to get a whole lot harder in the face of recent huge increases in global sawmilling capacity**, and into a massively over-supplied global sawn timber markets.

** Extra new annual sawmilling timber capacity being built in Central Europe alone between 2020 and 2022 will be as much as the total NZ timber export volume. Ditto in Russia (and much more). Ditto recently/now/soon in the US South -- so much that two huge new sawmills (Klausner in NC and FL) have just gone bankrupt.

FOR THE ABSENCE OF DOUBT: For every 1.0 cubic metres of new export timber market the NZ sawmilling sector has found since 2002, it has lost another 1.01 cubic metres.

- A plethora of inefficient, high cost, over-manned, low technology mills, made worse by the incompetence of many NZ sawmill owners, managers and advisors have resulted in the failure of 55 sawmills in the last 16 years. The details can be seen here

Chinese sawmills are 15-20% more efficient than NZ sawmills by conversion from log to timber (which equates to twice the profitability than NZ sawmills); and up to five times better by conversion from log to plywood.

- For the NZ sawmilling industry to be internationally competitive, the 60 existing mills must be replaced with <10 big new automated ones, with a loss of at least 75% of existing sawmill jobs.

- NZ mills cannot increase exports of plywood or Laminated Veneer Lumber (LVL) against vicious and increasing competition from Chile, Russia and Europe. NZ exports of plywood and LVL have fallen by 70% in from 2005 to 2018 -- which forced the closure of one plywood/LVL mill in 2018 (Juken in Gisborne) and soon 70% of one LVL mill in 2020 (CHH Whangarei).

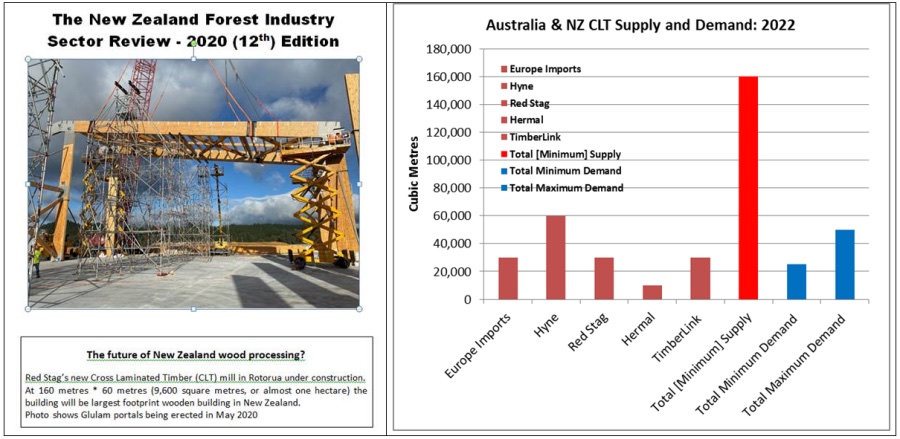

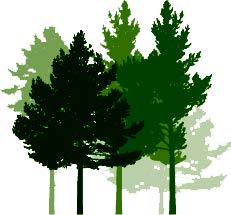

- The Minister talks about the new “wonder product” of Cross Laminated Timber (CLT). But CLT is already over-supplied in Australasia, which caused the closure of NZs only CLT mill (Nelson) in 2018.

Once the new Red Stag CLT mill is commissioned in 2021 (see below), with more new mills in Australia (and the massive expansion of CLT capacity in Europe -- by 20 times Australasia’s demand), the NZ + Australia oversupply will be savage, chronic and permanent. Trans-Tasman CLT production capacity alone in 2022 will be 3 to 7 times demand (see chart below).

Any new entrant in NZ making CLT would be instantly crushed by the competition. See below DN estimate of 3 June 2020.

Ask the NZ Wood Processing and Manufacturing Association (NZ WPMA) -- and/or any advisors/specialists/experts at MPI or Scion to analytically unravel any/all the above with their own version of “facts”. I hope they can. I sincerely hope they can.

Disclaimer: Personal views expressed in this blog are those of the writers and do not necessarily represent those of the NZ Farm Forestry Association.

Farm Forestry New Zealand

Farm Forestry New Zealand

5 posts.

Post from Howard Moore on June 4, 2020 at 8:27PM

Dennis may well be right, but Shane Jones knows that people get marks for Heroic Failures. If he succeeds he gets Brownie points for winning; if he fails he gets Brownie points for trying against overwhelming odds. Nothing to lose!

I think what frustrates Dennis is that the market doesn’t always work on facts; and while it may realise facts, there is always a lag between realising and adapting. Logic, Truth and the Greater Good do not lead to instantaneous change. Humans aren’t machines.

But I note that if processors reduce to just a handful of big mills, there won’t be any local processing in most regions except through portable mills. Some implications there. Time to move our forests closer to ports…

Post from Hans Brink on June 6, 2020 at 9:50AM

" Time to move our forests closer to ports" That will be interesting. In reality forest owners will be competing for land with pretty much every other more competetive food producing buisness. Makes no sense.Our forests are already where they are. Many first rotation forests have completed internal infrastructure, skid sites roading etc and the land is paid for. Obviously these areas must be replanted for future continues harvests to utilise this infrustructure. If we have to provide logs to overseas industry so be it. It is stll export income for NZ. In short it would be silly to plant land capable of other high value food prodution, in forest when we have plenty of low producing land in the hills. Hans Brink

Post from Howard Moore on June 10, 2020 at 5:10PM

Thanks Hans, understood. I was making an oblique reference to work done by Graham West and reported at the Rotorua NZFFA conference last year. He looked at where land was available and found 74,000 ha of class 6 land with a site index of 34 or greater within 1 km of a public road and 50 km of a processing facility or port. This land should be eminently profitable for commercial forestry, but it is not being planted.

Post from Rachel Rose on June 12, 2020 at 9:28PM

I assume this is in relations to Jones comments around his Forests (Regulation of Log Traders and Forestry Advisers) Amendment Bill. I've tried to find where in the bill he can manipulate the industry like how he describes but all I can find is a mention in the treasury regularity impact statement (https://treasury.govt.nz/publications/risa/regulatory-impact-assessment-strengthening-integrity-forestry-supply-chain-licensing-and-registration) of a couple of objectives that were dropped relating to Export Taxes and Sales Preferences for Domestic Processors. From what I can see we are wasting our time on a non existent issue. Or am I missing something?

Post from Hans Brink on June 19, 2020 at 4:34PM

Yes you are missing something. Quoting Woodnet "Many of the hundreds of submitters on the bill had been concerned the Govt may use those powers to set a volume quota, or a cap on log prices, for domestic prossesing" Shane Jones himself has indicated for awhile, that he is in favour of cheaper logs internally. A total distortion of market forces.

Add a post