Market Report May 2024

Reduce the Cut

This is my first market report for 2024. It still continues to be difficult to prepare quarterly forestry reports which promote any confidence regarding current and future log markets. Unfortunately, any bad news related to forestry, such as the current market downturn rarely gets the media coverage which other agriculture sectors do. The current downturn has come in quickly and was unexpected, and definitely unwanted considering the volatility experienced throughout 2023.

It is now clear that New Zealand needs to reduce the national harvest cut to match the reducing demand and this will probably come from the regional private sector, small-scale forest owners in general.The current market downturn is going to have a serious effect on the regional logging contractors resulting in a loss of skilled labour and infrastructure that will not return when the market recovers.

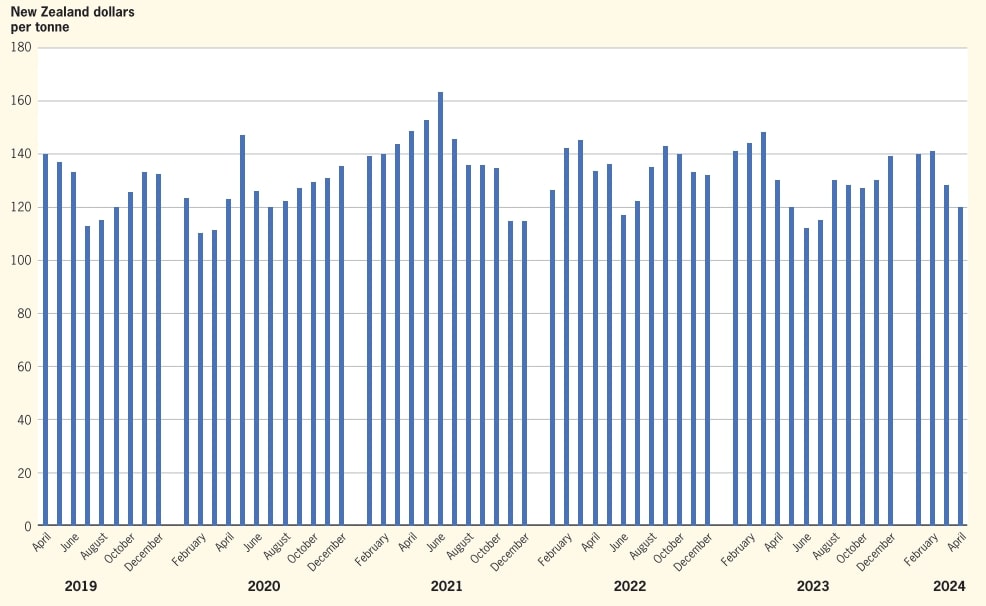

As highlighted in the graphs, the pricing trends over the last three years indicate the annual highs and lows of the market.This volatility is likely to remain with reducing demand, and where customers must control supply by price.

Complex and difficult

The current and future export log markets are complex and difficult to explain, other than logs continue to operate as a commodity, with many exporters competing and operating through New Zealand ports. We can expect reducing demand with the loss of lower value grades, for example the KI and KIS grades – small industrial saw log also – may fall into biofuel markets. There are two export supply sources emerging and will compete.They are the central North Island corporate owners and private regional owners who will struggle due to the high costs of first rotation crops.

Private regional owners underestimate their collective strength within New Zealand supply chain. This has been highlighted over the years by Hamish Levack and Howard Moore with their work undertaken in considering cooperatives or collective forestry.The current market trend now highlights that this type of initiative could have provided private owners of smaller forests with greater value opportunities and negotiating strength.

The problems which a cooperative would have to consider are –

- Relying on export markets will continue, logs will be traded as a commodity and prices will be set by customers to control supply because New Zealand has too many exporters competing in the same market.The annual log demand from China is reducing and the annual harvest needs to fall to match demand. If not, customers will control the New Zealand supply by price which is the current norm.

- New emerging markets such as India only want certain log grades and are a difficult customer, compounded with many other logistical problems

- Private forest owners should not be naive to think they can compete with the much more efficiently produced second and third rotation crops from the central North Island forest owners as demand reduces Each two-to-three-month price correction continues to erode skilled labour and infrastructure as contractors get shut down or slowed down which will affect regional infrastructure.

Market outlook

December 2023 sale prices started to trend upwards due to depleting China stocks, along with more stable shipping costs and combined with some minor Chinese government stimulus into manufacturing.The January and February prices continued to improve, with exporters expecting price stability through March and April. Unfortunately, the latter part of March produced an unexpected kick in the rear as export gate prices suddenly started to fall. Prices in April prices were around $30 lower than the March prices.

Over Chinese New Year in February, log stocks in China increased from around 2.3 million cubic metres to 4.1 million cubic metres with large stocks in transit from New Zealand creating a supply and demand imbalance, removing some of the price leverage exporters had earlier in the year.The Chinese economy in manufacturing and construction continues to remain weak and is not expected to improve significantly in the short to medium term.

Log shipments have started heading to India, Korea remains steady, although China continues to remain the price setter for global logs. Many believe India will be the new emerging log market, in the way China replaced Korea as demand dropped from an annual nine million cubic metres in the late 1990s to around two million cubic metres.

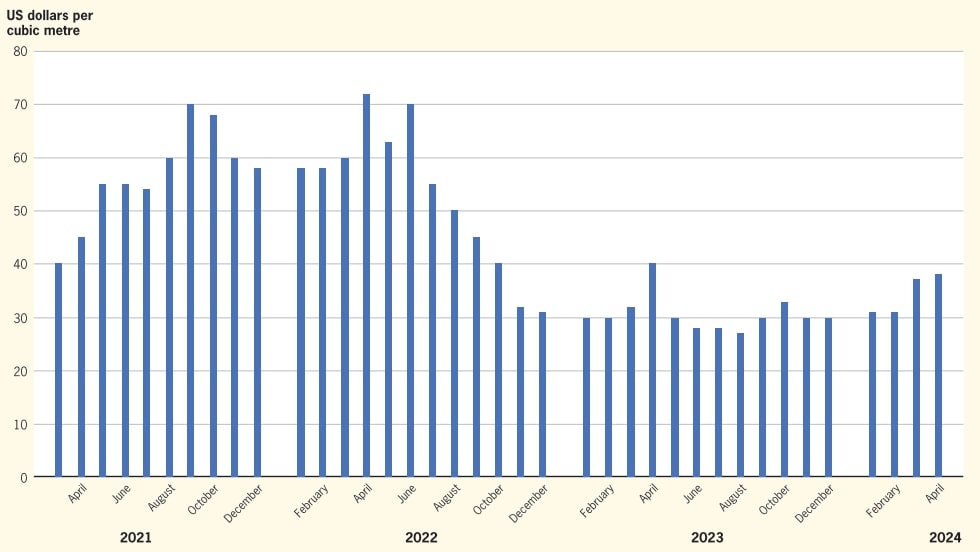

Shipping rates increased considerably in late March due to a number of factors including a shipping supply imbalance between the Atlantic and Pacific regions.

Higher shipping demand for logs and Australian grain shipments has seen shipping rates jump from US$30 to US$37 a cubic metre in late March and early April. It is expected that these rates will ease by early May.

The log sale price has been ranging from US$120 at the end 2023 to US$130 in late February, falling in late March by $10 to $15. Exporters found it difficult to finalise sale contracts for April.The nett result for April is a considerable price reduction due to the increasing stock levels and higher shipping rates, all affecting the wharf gate prices in New Zealand.

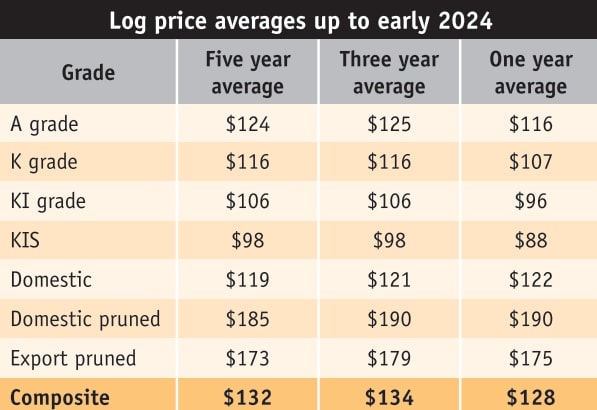

The graph above highlights the composite price of all log grades combined, highlighting the continual price volatility.

The domestic market for pruned and unpruned sawlogs logs remains stable. Unfortunately, there are not enough domestic processing plants in many regional locations.With a weakening export market, the trend will be less harvest production.This means that log supply pressure is being experienced in many mills.

Kelly Coghlan is a director of TAML forestry.Log price table key

Understanding the figures (below)

- Domestic prices are per tonne landed "at mill door".

- Prices are GST exclusive.

- Export prices are per JAS cubic metre landed "at wharf gate".

- The absence of data reflects insufficient sales.

- Prices above or below those indicated are entirely possible if wood quality exceeds or is below the normal market expectation.

- P1 AND P2 grades are pruned logs with a minimum 40cm SED and 34cm SED respectively (note SED = Small End Diameter)

- S30 and S20 grades are small branch logs with a minimum 30cm SED and 20cm SED respectively

- L30/A30 grades are large branch logs with a minimum 30cm SED

- K grade are export logs sold to Korea. KA grade is better grade log with a minimum 30cm SED. K grade are smaller standard multi purpose logs and KI is a large branch large Industrial log.

- S30 price for Northern South Island relates to N35 grade

Radiata pine log sales

| NZ$ per tonne |

North NI

|

Central NI

|

South NI

|

North SI

|

Central SI

|

South SI

|

|---|---|---|---|---|---|---|

| P1 (P36-P38) |

172-192

|

175-190

|

170-180

|

172-180

|

167-175

|

175-185

|

| S30 |

125-140

|

125-133

|

120-125

|

120-126

|

120-125

|

122-127

|

| S20 |

116-121

|

111-116

|

101-106

|

109-113

|

96-101

|

-

|

| L30/A30 |

101-110

|

-

|

-

|

-

|

95-105

|

100-105

|

| Postwood |

82-95

|

90-100

|

84-94

|

72-90

|

90-100

|

82-93

|

| Chip |

54-59

|

48-52

|

46-51

|

45-50

|

50-54

|

44-48

|

| NZ$ per JAS | ||||||

| Pruned (P40) |

181-185

|

184-188

|

174-178

|

168-172

|

161-165

|

172-176

|

| Pruned (P32) |

146-150

|

149-153

|

139-133

|

137-141

|

131-135

|

135-139

|

| A grade |

127-131

|

129-132

|

117-120

|

119-122

|

111-114

|

115-118

|

| CS/KS |

122-126

|

124-128

|

113-117

|

115-119

|

104-107

|

108-111

|

| CI/KI |

109-113

|

111-114

|

102-105

|

104-108

|

96-99

|

105-109

|

| Pulp (CIS/KIS) |

104-107

|

106-109

|

109-111

|

98-101

|

89-92

|

95-98

|

Comparing JAS and a tonne of logsThe conversion rate from a JAS cubic metre and a tonne of logs is usually about 0.95 although this can vary. It depends on −

If we accept an average day, average site and the 0.95 conversion rate, an export log grade comparative for an S30 log sold domestically would need to be about $137 per JAS to compare with a $130 a tonne for a domestic sale. |

||||||

Macrocarpa log sales

| Macrocarpa logs | South Island Landed at mill door/tonne |

North Island Landed at mill door/tonne |

|---|---|---|

| Pruned Min SED 40cm | $350 - $375 | - |

| Pruned Min SED 30cm | $170 - $190 | - |

| Small branch Min SED 30cm | $160 - $175 | - |

| Small branch Min SED 20cm | $140 - $150 | - |

| Large branch/Boxing/Sleeper | $120 - $125 | - |

| Firewood logs | $75 - $85 | - |

Kelly Coglan is Director of Taml Forestry in Taranaki.

Farm Forestry New Zealand

Farm Forestry New Zealand